Pharmacy Benefit Management in Nigeria - Africa's Pill Pack

McKinsey reports indicate that the Nigerian pharmaceutical market could reach US$3.6 billion by 2026, with several pharmaceutical wholesalers and distributors operating in the market. Before drugs reach Nigerian patients, they go through several levels of distribution, including the main distributor and several sub-distributors. At each step in the pharmaceutical supply chain, distributors can add markups of up to 10% onto the cost of the drugs. At the last step in the supply chain, when public hospitals/pharmacies are out of stock of prescription drugs, patients are often diverted to private pharmacies, where markups along the supply chain are even more pronounced. As such, markups between drug manufacturers and patients are often around 80%, with pharmacies and distributors adding markups around 30-40% each.

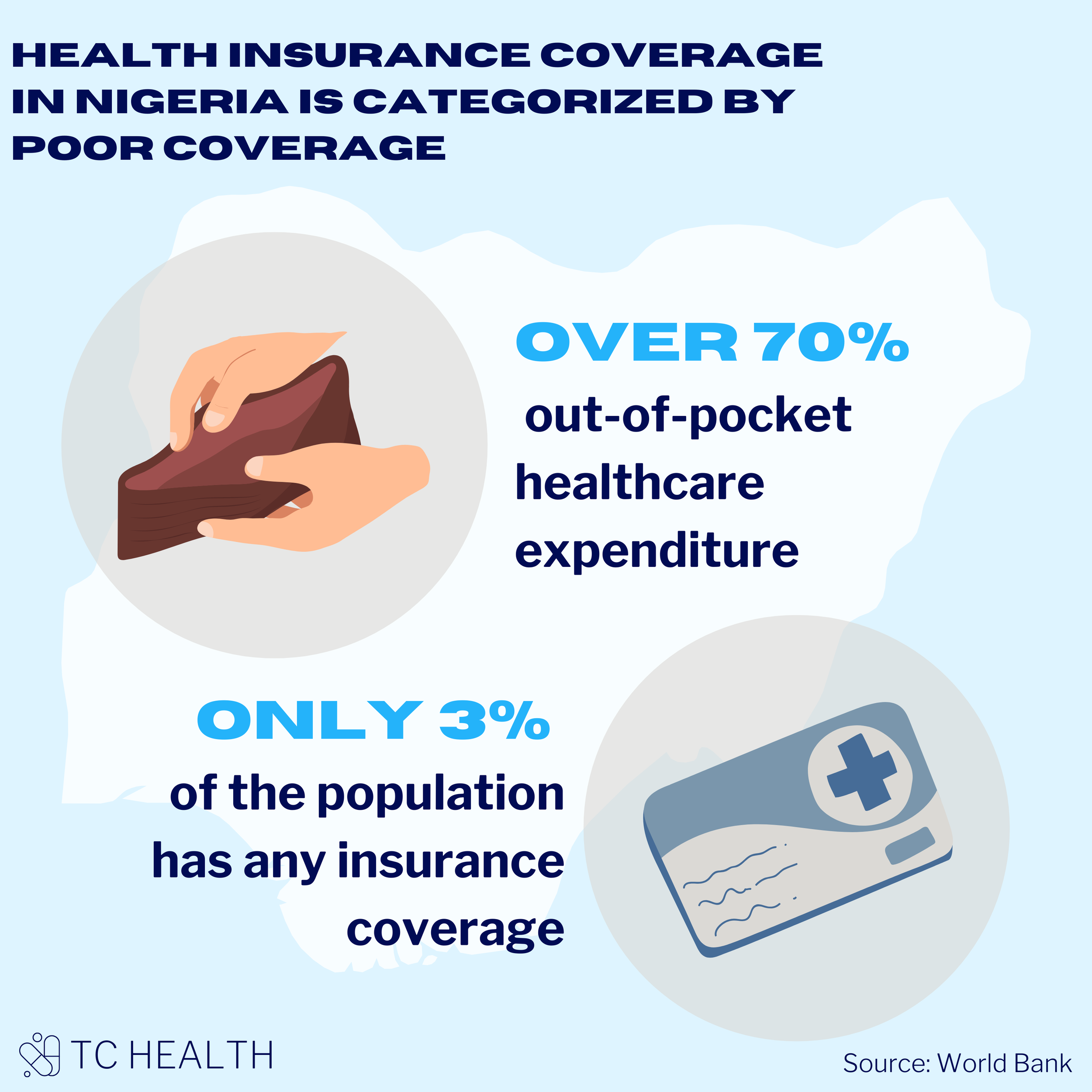

But how are Nigerian patients paying for these exorbitant drug costs? Out-of-pocket payments account for over 70% of healthcare expenditure in Nigeria. The HMO coverage in Nigeria as of 2020 was less than 10%, and as of 2021, 97% of the population did not have any form of health insurance at all.

Despite these abysmal numbers, there are giants in the healthcare industry. HMOs across the country have grown substantially and cover a massive amount of claims. For example, Leadway Health Limited announced that they covered roughly N800 million in medical bills for their 62,000 members and 120 corporate clients in 2021. AxaMansard is another giant in the HMO industry, with N4.2 billion in capital as of December 2021 and Hygeia HMO is dispensing medications to the tune of N75 million every month.

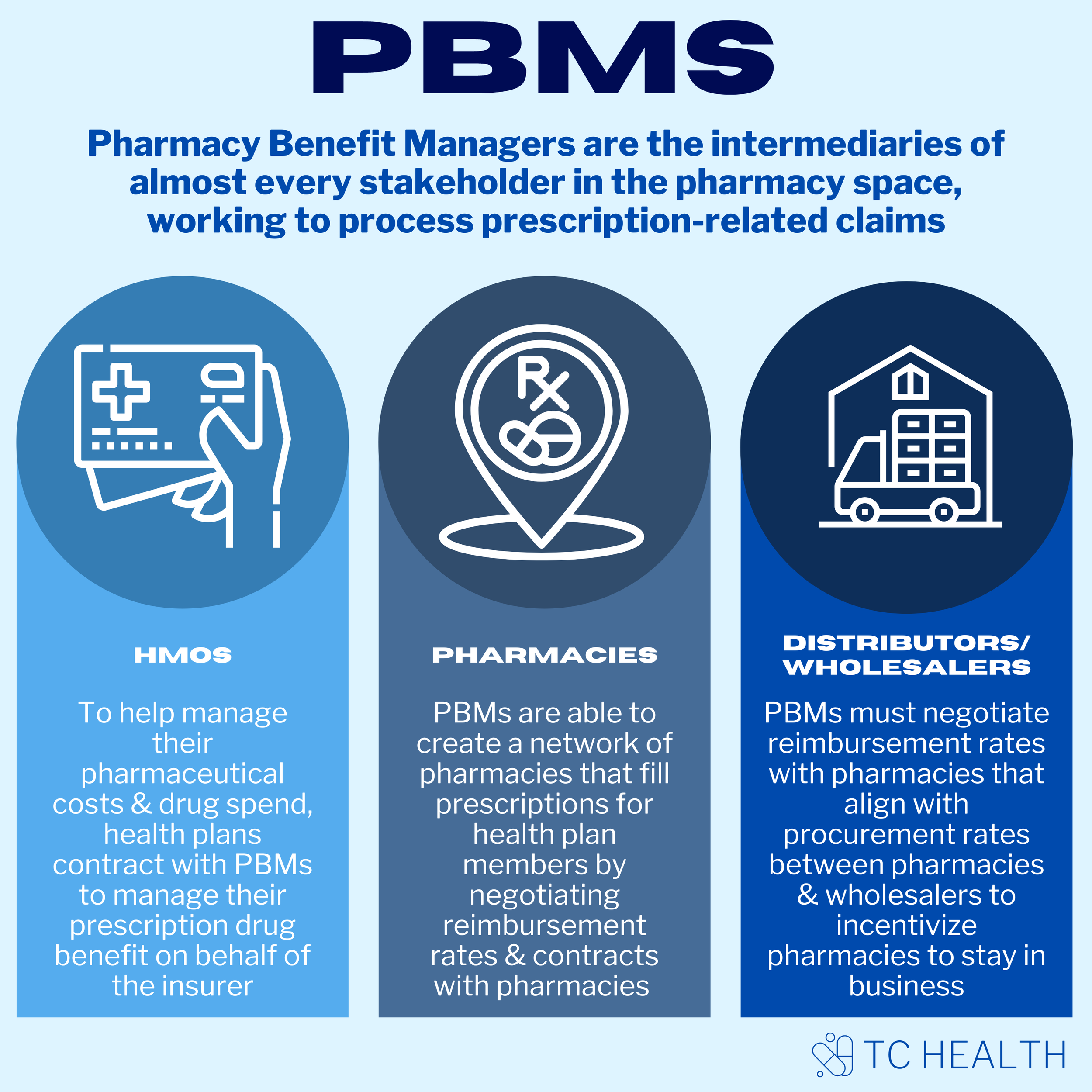

With over 60 HMOs and thousands of pharmacies operating in the market, effectively managing the large prescription volumes in the country is crucial to the sustainable growth of the industry. And that’s where PBMs come in. Pharmacy Benefit Managers, also known as PBMs, are the intermediaries of almost every stakeholder in the pharmacy space. PBMs are hired by HMOs, corporate employers, labor unions, and other organizations, to interface with drug manufacturers and process prescription-related claims. Essentially, PBMs are the connectors between employers, health plan members, drug wholesalers, pharmacies and drug companies, working to facilitate the best possible health outcomes at the best possible costs.

This article is the first in a series of thought pieces that aims to dig deeper into the PBM space in Nigeria, the different hurdles faced by each stakeholder within the pharmaceutical supply chain and the impact of PBMs at each step of the way.

But first, a baseline understanding of how each stakeholder interacts with a PBM is required in order to understand this fragmented and complex industry, particularly in a market like Nigeria with massive pockets of opportunity and endless growth potential.

HMOs

To help manage their pharmaceutical costs and drug spend, health plans contract with PBMs to manage their prescription drug benefit on behalf of the insurer. In an effort to control costs, PBMs negotiate payment rates with drug manufacturers by using drug formularies, drug evaluation tools and cost reduction techniques to control patient access to the most cost-effective medications, particularly for high-cost specialty medications. As such, PBMs can have a significant impact on determining the total drug costs for health plans and shaping patients’ access to drugs.

Pharmacies

PBMs are responsible for reimbursing pharmacies for dispensing patient medications. To do this, they determine in advance how much they will reimburse pharmacies for each drug covered under an HMO’s health plan. PBMs are able to create a network of pharmacies that fill prescriptions for health plan members by negotiating reimbursement rates and contracts with pharmacies and developing drug programs to control costs (e.g., programs to substitute more expensive drugs for lower-cost options).

Wholesalers/Distributors

While PBMs typically do not directly interact/negotiate with wholesalers/distributors, they negotiate contracts with pharmacies, including those in their network, to set reimbursements for the drugs dispensed by the pharmacy. Pharmacies in turn negotiate agreements with drug wholesalers, setting the wholesale rates at which they obtain the drugs, and wholesalers negotiate to buy drugs from manufacturers and distribute them to pharmacies. As such, it is important that PBMs and pharmacies are able to negotiate appropriate reimbursement rates that align with negotiated procurement rates between pharmacies and wholesalers and incentivize pharmacies to stay in business.

While Nigeria’s PBM industry is still in its infancy, the US provides a glimpse into the future of the substantial growth potential of the PBM space. The US is responsible for the largest share of PBMs globally, likely due to the number of large pharmaceutical manufacturers in the country and the systemized, fragmented sector of health insurance plans that are dependent on PBMs - all these factors work together to make pharmacy benefit management highly profitable. The three largest PBMs in the US - CVS Health, Express Scripts and OptumRx - processed ~77% of the prescription drug claims in the country in 2020, and the top 6 PBMs processed 95% of claims. In fact, PBMs in the US have become so large that they have acquired managed care organizations (i.e., health plans) to enable synergies. In 2018, CVS Health acquired Aetna for $69 billion and OptumRx acquired Davita Medical Group for $4.9 billion.

However, beyond the US, low- and middle-income countries (LMICs) are expected to experience rapid development in the PBM industry in the coming years due to the increasing infrastructure for healthcare. PBMs in LMICs face huge growth opportunities due to large populations, unstable and fluctuating drug pricing and poor national insurance coverage, creating a significantly eye-catching market to capitalize.

For instance, South Africa has a two-tiered, and highly unequal healthcare system. The state-funded public sector covers the majority of the population (71%) but is considerably underfunded, while the private sector covers around 27% of the population but is characterized by exorbitant costs. Unsurprisingly, the PBM industry in South Africa has seen some growth to cover the clear gaps in the healthcare system. Four notable PBMs in the country include Medpharm/PBM Limited, Mediscor, Interpham and Medikredit. Mediscor, for example, covers more than 2 million lives and processes over 150,000 claims each day.

PBMs have also seen growth in Brazil since their inception in the 1990s. Brazil has a number of PBMs, including EPharma, Orizon, Vidalink and Functional Card. PBMs in Brazil have ~2 million members but still have a long way to go to cover a significant portion of the 210 million Brazilian population. As such, the sector is expected to see even more growth. For example, EPharma launched in Brazil in 2000 and soon became the most well-known PBM in the pharmaceutical retail market. In 2010, EPharma reached 10,000 accredited pharmacies in Brazil and its considerable growth sparked foreign investment. In 2013, Valiant Capital Management, a San Francisco-based hedge fund, and Aberdare Ventures jointly acquired a 45% stake in EPharma, with an estimated value of $74.6 million.

So how is the Nigerian PBM space making headway in the pharmaceutical market? Almost all HMOs in the country currently process their massive claims using simple Excel models, leading to large inefficiencies and avoidable costs in prescription dispensing. Health tech startups are developing tech solutions to drive incentives and improve efficiency for each stakeholder in the drug dispensing process.

WellaHealth is a health tech company providing micro health insurance for high occurrence diseases in Africa, starting with malaria in Nigeria. WeFill, a unique brand within the WellaHealth group of businesses, plans to be the pill pack of Africa by handling every aspect along the supply chain, from working with distributors and manufacturers, and leveraging contracts with HMOs to drive drug costs down and pass on cost savings to HMOs and patients. To achieve this, WeFill is using data to predict drug demand better and catch drug-to-drug interactions; using AI to catch prescription errors; and developing patient support programs for their partner health plan members.

As the prevalence of non-communicable diseases rises in the country and the care delivery model shifts towards preventive care, artificial intelligence and predictive analysis are becoming increasingly crucial to analyze the massive volume of HMO claims data and customize care management programs. These programs have the potential to support healthcare providers to prescribe the most appropriate and effective drugs, improve medication adherence and compliance and reduce unnecessary costs, particularly for some of the costliest drug classes (e.g., cancer, diabetes, high blood cholesterol and inflammatory diseases). For example, HMOs in Nigeria pay between N8,000-10,000 each time a patient visits the hospital for malaria treatment and, through their network of pharmacies, WeFill could drive down costs to N2,000-3,000 and reduce time spent and transport costs to hospitals.

Key Takeaways from TC Health: Despite chronically low insurance coverage, HMOs continue to process large claims volume, and markups remain high along the supply chain; as such, drug costs will continue to be passed onto Nigerian patients. Pharmacy benefit managers that are able to provide new technology solutions such as artificial intelligence and predictive analytics will be critical in ensuring medication adherence to control spending and improve population health. Stay tuned for the rest of the PBM series!