The Cost of Healthcare in Nigeria: How PBMs are Tackling HMOs' Challenges

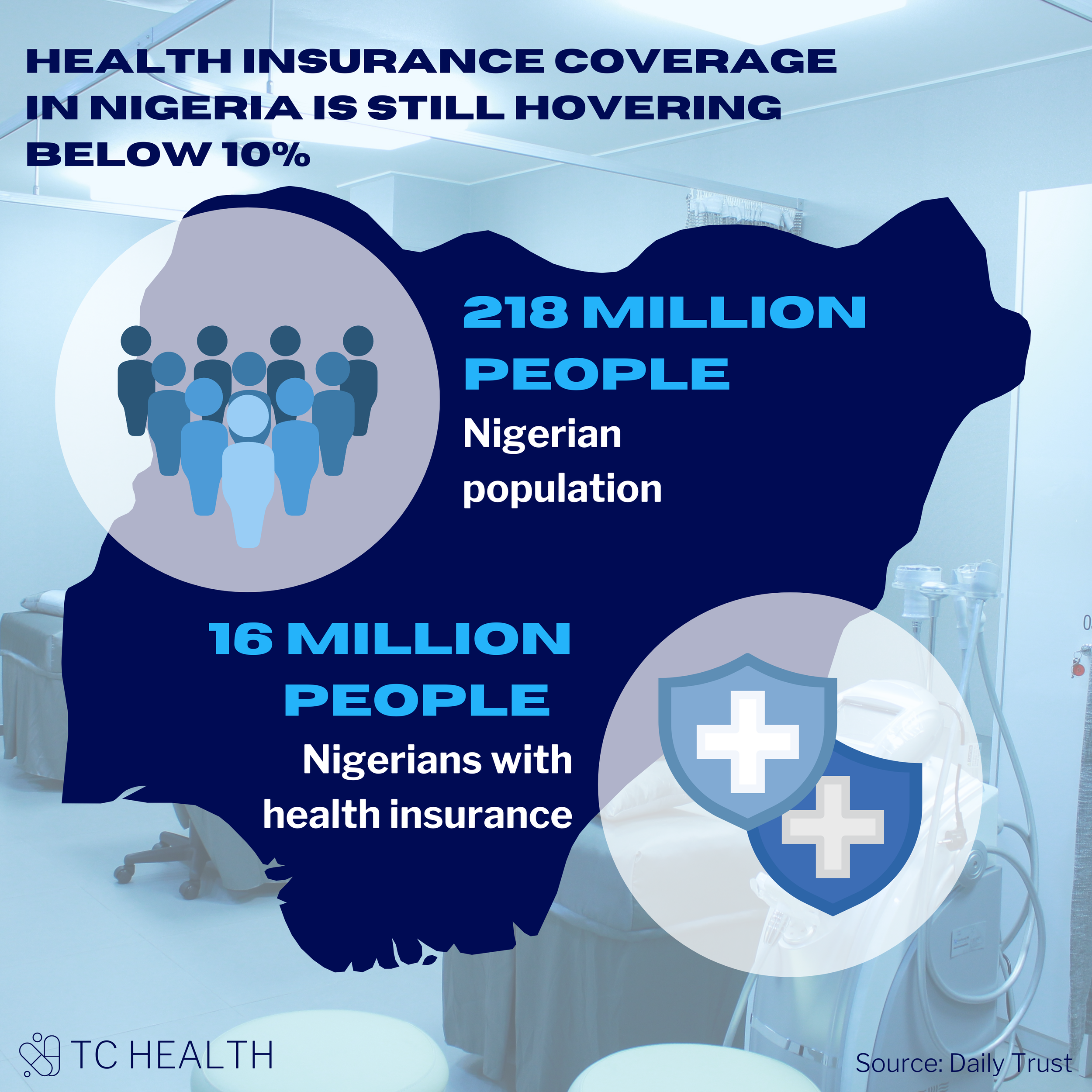

Despite a population of ~218 million people, there are 68 NHIS-accredited HMOs operating in Nigeria. Only about 16 million people have health insurance coverage, meaning the coverage level for Nigerians is still hovering below 10%. Given the level of competition within this relatively small market, HMOs face an array of challenges to provide healthcare coverage effectively.

Pharmacy benefit managers (PBMs) play a crucial role in solving some of these challenges within the HMO industry. PBMs work as an arm of HMOs saddled with the responsibility to manage the prescription drug benefit, ensure drug fulfillment and compliance, and provide advisory services to the enrollees.

This article is part of a series of thought pieces that aims to dig deeper into the PBM space in Nigeria, the different hurdles faced by each stakeholder within the pharmaceutical supply chain, and the impact of PBMs at each step of the way. In this part of the series, we dive deep into the relationship between PBMs and HMOs.

Unsurprisingly, one of the biggest challenges for HMOs in Nigeria is costs. Healthcare costs in the country have surged to unprecedented levels despite strategic interventions by the central bank and the government to mitigate the effect of the pandemic on the economy. According to the National Bureau of Statistics, the composite consumer price index for health reached a record high of 17.05% in November 2022, primarily driven by the rising cost of pharmaceutical products and medical, dental, paramedical, and hospital services. Without an effective way to contain these increasing healthcare costs, sustainable growth and scale for HMOs will remain out of reach.

In early 2022, these cost issues almost halted business between HMOs and providers. The Healthcare Providers Association of Nigeria (HCPAN) and other major provider groups announced plans to stop all operations with HMOs across the country. The main reason for this highly polarizing, industry-level action was the “abysmally low” reimbursement rates and the massive backlog of debts owed by HMOs. The provider groups claimed to suffer losses due to the disparity between HMO premium payments for their enrollees and the rising cost of healthcare services. As such, the HCPAN demanded that HMOs adjust their reimbursement rates to be more in line with the increasing cost of healthcare. Ultimately, the NHIS (the regulator of the health insurance industry) had to intervene to resolve the dispute between providers and HMOs.

The rising cost of healthcare services and medications has put HMOs under constant pressure from providers to increase tariffs and reimbursable rates. However, to stay afloat, HMOs would have to increase the premiums they charge their enrollees, which is easier said than done for several reasons. Negotiating new premiums and updating existing contracts with employers, corporate clients, and enrollees involves many bureaucratic processes. Additionally, the HMO and private health insurance market is very small relative to the Nigerian population of 218 million people. This introduces significant pressure for HMOs to remain competitive with their premium pricing and maintain market share.

While the private insurance market is relatively small, HMOs across the country have grown substantially and cover massive claims volumes. The effort required to process these claims while minimizing costs is another big challenge for HMOs in the country.

According to Ozy Enyinna, Head of Pharmacy Benefit at a Nigerian HMO, two significant challenges for HMOs beyond the rising cost of healthcare are the lack of cost-sharing between HMOs and enrollees and the cost of innovator brand medicines.

The NHIS provides public health insurance coverage and requires its enrollees to pay a 10% coinsurance out-of-pocket for the total cost of drugs dispensed. However, most private HMOs in the country do not have cost-sharing schemes (e.g., coinsurance, copayment, deductibles, etc.) within their benefit designs and cover the total cost of treatment for their enrollees (i.e., no out-of-pocket costs). As a result, private sector enrollees are not highly cost-sensitive and typically do not object to the treatment options their physicians prescribe based on cost. Private HMOs must bear the burden of closely monitoring prescription claims to avoid unnecessary care and cost for primary enrollees and their dependents. A 2016 case study of HMOs in Nigeria found that manually collecting and processing utilization data from providers, verifying claims, and paying hundreds of providers monthly and separately (for public and private plans) caused a substantial cost burden across HMOs in the country. Most HMOs also use outdated technology, such as Excel, to process their massive claims volume, leading to further inefficiencies.

Innovator brand medicines are also a high cost to HMOs. As a result of the influx of fake and substandard drugs into the country, physicians and patients are highly hesitant to prescribe and use cheaper, generic versions of drugs. Private sector enrollees prefer to use innovative brand medicines given their general lack of cost sensitivity. No national policies exist that require physicians or pharmacists to substitute more expensive innovator brands for cheaper, generic versions. Hospital pharmacies place high markups on these drugs, adding to the cost. All these dynamics compound together to put the high-cost burden for these innovative, brand medicines on HMOs even when cheaper options are available and HMOs struggle to steer patients and physicians towards more inexpensive alternatives.

So, where do PBMs come in?

Drugs and consumables make up a quarter (25%) of claims volume among Nigerian HMOs. This presents a huge opportunity for PBMs to manage prescriptions and drug dispensing efficiently and allow for cost savings.

To control costs, PBMs negotiate payment rates with drug manufacturers by using drug formularies, drug evaluation tools, and cost-reduction techniques to manage patient access to the most cost-effective medications, particularly for high-cost specialty medications. As such, PBMs can significantly impact the total drug costs for HMOs and shape patients’ access to drugs.

One notable example of a PBM working with HMOs to reduce costs in the Nigerian context is WeFill. WeFill, a unique brand within the WellaHealth group, is a third-party administrator that manages medication-related services on behalf of HMOs. They are working with HMOs to automate chronic drug processes, using features such as refill and predictive lists. WeFill is also automating claims filing for partners by working with their tech partners - their most significant success is with Reliance HMO, where they were able to achieve end-to-end automation for their patient experience. Based on monthly partner reports, WeFill is driving down costs for partners by up to 23%; with a reach of over 110,000 enrollees and almost 2,000 drugs across all states in Nigeria, the impact of such savings is substantial.

Key Takeaways from TC Health: With the rising cost of healthcare in the country and constant pressure for HMOs to remain competitive, there is a massive untapped opportunity in the market for PBMs. PBMs that can leverage tech solutions and predictive analysis to drive costs down will allow for scalable and sustainable growth in the HMO sector. In the public sector, policies to manage the level of competition within the small HMO market and cost controls (e.g., generic substitution) to incentivize the use of safe, inexpensive options among the population will also be crucial to growth in the industry. Stay tuned for the rest of the PBM series!